Boomer Business Owners: The Silver Tsunami is Coming, Are You Ready?

As a Boomer business owner, now is the time to consider the next right steps for your business and your life. The coming decade will produce a wave of business sales as Boomers cash out; planning ahead will help you make good decisions for your best possible retirement.

Business owners approach retirement planning in one of two ways. Are you more like our friend Melissa, who has planned her ideal retirement for years, or Joan, the expert operator who works in the business every day, but makes short- to medium- term plans? Melissa knows that her future includes time with family, travel, and hobbies, so she has been putting in motion an employee buy-out of her company. Joan thrives in the day-to-day operations of her business and says “someday” she will think about selling.

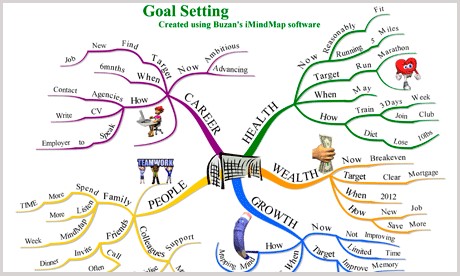

Many Boomer business owners would like to sell their businesses to a family member or employee. It is important to determine your ideal vision for your business NOW. All ideas have merit, and it can be an overwhelming decision. One way to approach the process is with a brainstorming technique coaches call “mind-mapping.”

I encourage you to start this process sooner rather than later because the statistics will give you pause. The California Association of Business Brokers notes that some 70 million Baby Boomers are “poised to make a great impact on the American economy.” Consider these facts:

- Retiring Boomer business owners will sell or bequeath $10 trillion worth of assets over the next two decades.

- These assets are held in more than 12 million privately owned businesses.

- More than 70 percent of these companies are expected to change hands.

- The sale of almost 12 million businesses over the next 10 to 15 years represents a significant increase in the annual number of businesses that will be sold.

The Silver Tsunami is coming, are you ready?

Let’s revisit our examples to illustrate the point: Melissa has been approached by a group of employees to buy her business. She knows these long-tenured employees are perfect to run the business. However, according to the statistics, that person may not have the financial means to purchase the business. So here are the three top questions (among many) to ask yourself:

- Are you able to finance the purchase yourself?

- What would be the tax implications of such an arrangement for you? For the new owner?

- What are your financial needs from the purchase of the business?

The outcome of the sale of your business depends on preparation. Did you know as the owner, you are responsible for negotiating the purchase and sale agreement? In that agreement, you are able to negotiate for your priorities. Sample priorities that I have seen in agreements:

- Employees and their 2-5 year future

- Community engagement and branding

- Financial needs of the owner

Now is the time to talk about legacy. If plans call for a family member to succeed you in ownership, legacy may be an UNSPOKEN social contract. Clear communication is key. Put every expectation, aspiration, and belief out there and then talk through each one. This isn’t the time to be defensive or get into an argument as to who is “right;” this is the time to govern by consensus.

Finally, engage in a visioning exercise. Decide what will you do next. Get specific. Identify your passions. Revisit your values. How will you show up in the rest of your life? If there are other people whose lives depend on the outcome of the sale of the business, this is the time to determine their values, priorities, and desires, too. Details such as geography, lifestyle, occupations, and rediscovering those passions all factor into this process. Each can become mileposts, metrics and measurables that assist in sticking to the path you’ve identified as the right one for you (and yours).